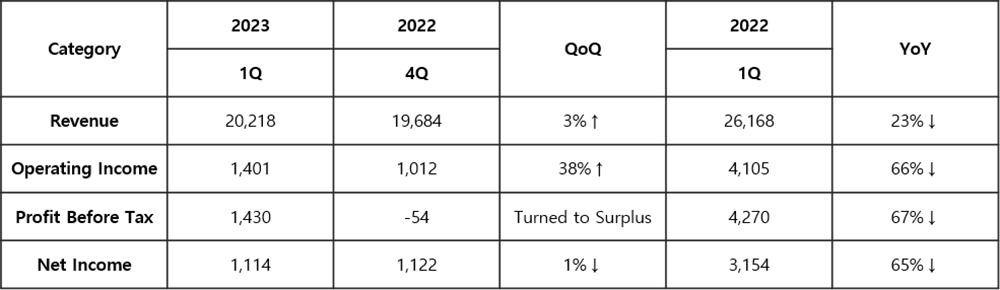

- ▶Achieved revenue of KRW 2,021.8 billion and operating incomes of KRW 140.1 billion for the Q1 2023

- - 3% increase in revenue and 38% increase in operating incomes QoQ (as compared to 2022 4Q)

- - Growth in the revenue of high-specification camera modules for flagship new models of strategic clients

- ▶As for the Q2, Samsung Electro-Mechanics estimates that its revenue will grow due to the increased demands for MLCC and the steady demands for automotive products

On April 26, Samsung Electro-Mechanics reported that it has achieved revenue of KRW 2,021.8 billion and operating incomes of KRW 140.1 billion on a consolidated basis for the last Q1.

Its revenue and operating incomes increased KRW 53.4 billion (3%) and KRW 38.9 billion (38%), respectively, on a QoQ basis, and decreased KRW 595 billion (23%) and KRW 270.4 billion (66%), respectively, on a YoY basis.

According to the explanation of Samsung Electro-Mechanics, although it has achieved an increase in revenue QoQ due to the expanded supply of high value-added components following the flagship new models launched by its strategic clients, its performance showed a decrease YoY, under the circumstances where the demands for IT devices such as PCs had shown continued downward tendencies due to the global economic recession.

In the meantime, Samsung Electro-Mechanics commented that, as for the Q2, it will not only focus on heightening the ratio of automotive and diversifying its clients for the respective business units, but also enhance its revenue compared to the Q1 figures, by increasing the sale of high value-added products such as small-sized/super high-capacity MLCCs, following the new products to be launched by its overseas clients, including the Chinese clients.

Quarterly Performances of Samsung Electro-Mechanics

(Unit: KRW 100 million)

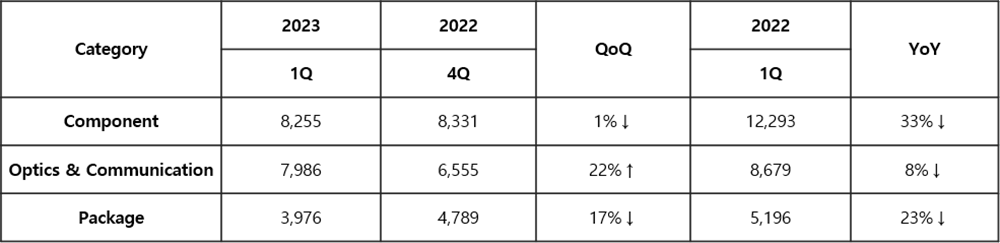

Performances and Forecasts for the Respective Business Units

For the Q1, the Component Unit has recorded revenue of KRW 825.5 billion, representing 1% decrease and 33% decrease on QoQ and YoY, respectively. As per Samsung Electro-Mechanics, although its MLCC shipping volume and supply of new electronic device products had increased with a focus on the Chinese regions, its performance declined due to the overall downward tendency in the set demands and the influence of exchange rates.

As for the Q2, Samsung Electro-Mechanics is planning to expand the supply of high value-added products such as small-sized/super high-capacity products, following the launch of new smartphone products in the Chinese regions, and to enhance its customer confrontations by enhancing the automotive product line-ups for which steady demands are forecasted.

The Optics & Communication Solution Unit has recorded revenue of KRW 798.6 billion, which represents 22 % growth QoQ, following the supply of high-function camera modules, such as high-resolution OIS and 10x folded zoom, and the increased sale of automotive camera modules, due to the flagship new models launched by strategic clients.

As for the Q2, in spite of the temporary off-season being expected, Samsung Electro-Mechanics has set up a plan to expand its supply of high-function camera modules and automotive products such as autonomous driving, to its overseas clients.

The Package Solution Unit has gained revenue of KRW 397.6 billion for the Q1, which represents decrease of 17% QoQ and 23% YoY, respectively. Samsung Electro-Mechanics remarked that its supply of package plates had reduced as a consequence of sluggish demands for IT sets such as smartphone/PC and continued adjustment of memory inventories.

In the Q2, Samsung Electro-Mechanics is expecting to expand its supply of package plates for mobile AP/memory and to increase the ratio of high value-added products such as servers/automotive.

Earnings by each Business Unit of Samsung Electro-Mechanics

(Unit: KRW 100 million)