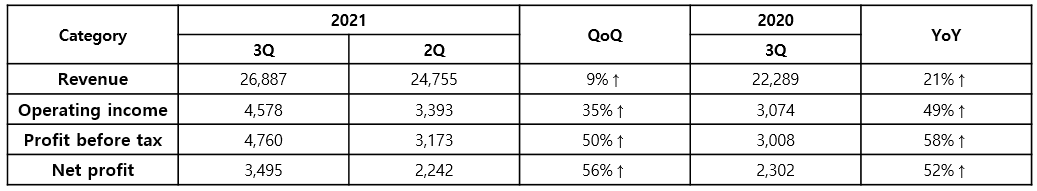

- ▶ Revenue of KRW 2.6887 trillion and operating profit of KRW 457.8 billion

- - 21% increase in revenue and 49% increase in operating profit compared to the same period last year

- - 9% increase in revenue and 35% increase in operating profit compared to the previous quarter

- ▶ Earnings improved thanks to increased supply of high value-added products such as MLCCs and semiconductor package substrates

- - Increased supply of small/high-capacitance MLCCs for mobile devices, industrial/automotive MLCCs, and semiconductor package substrates

- ▶ In 4Q, demand for high value-added products such as industrial/automotive MLCCs and package substrates to be strong

Samsung Electro-Mechanics announced on October 27 that it posted revenue of KRW 2.6887 trillion and operating profit of KRW 457.8 billion on a consolidated basis in the third quarter of 2021.

This marks YoY increases of KRW 459.8 billion (21%) in revenue and KRW 150.4 billion (49%) in operating profit, and QoQ increases of KRW 213.2 billion (9%) in revenue and KRW 118.5 billion (35%) in operating profit.

The company explained that its earnings improved significantly compared to the same period of last year on the back of increased sales of high value-added products, such as small and high-capacitance MLCCs for mobile devices, industrial and automotive MLCCs, and high-end semiconductor package substrates.

In the fourth quarter, sales of some products are expected to decrease due to set inventory adjustments at the end of the year, but demand for high value-added products such as MLCCs for smartphones and industrial/automotive use as well as package substrates for AP and 5G antennas is expected to remain strong.

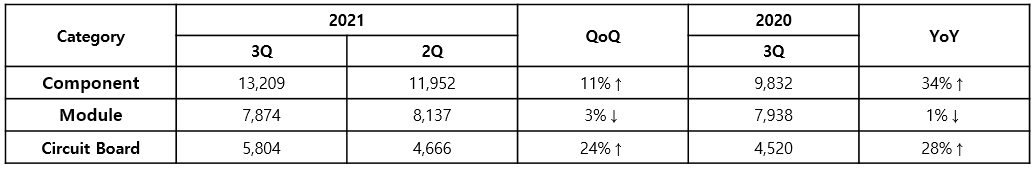

Earnings and Forecast by Business Unit

In Q3, the component business achieved revenue of KRW 1.3209 trillion, up 34% YoY and 11% QoQ, thanks to the increased supply of high value-added MLCCs such as small and high-capacitance products for smartphones and industrial and automotive MLCCs.

In Q4, demand for PCs and TVs is expected to decrease due to slowing set growth and inventory adjustments, but demand for high value-added MLCCs for smartphones and industrial/automotive use is forecast to remain strong. Samsung Electro-Mechanics plans to actively respond to market demand by increasing productivity.

In Q3, the module business recorded revenue of KRW 787.4 billion, down 1% YoY and 3% QoQ.

The company explained that sales of high-performance slim camera modules increased with the launch of a new foldable smartphone model by a strategic partner, but overall revenue decreased due to slowing demand in the Chinese smartphone market.

In Q4, the company plans to differentiate its products based on the internalization capacity of lenses and actuators and expand the supply of next-generation high-performance products to major partners.

The circuit board business posted revenue of KRW 580.4 billion, up 28% YoY and 24% QoQ.

Performance of semiconductor package substrates improved thanks to the increased supply of BGAs for high-end APs and 5G antennas, and FCBGAs for thin laptop CPUs.

In the fourth quarter, demand for high-end package substrates for AP, 5G antennas, and networks is expected to continue.

Samsung Electro-Mechanics plans to increase profitability by expanding the supply of high value-added products, such as BGA for smartphone AP and FCBGA for thin CPU, and to actively respond to market demands based on core technologies such as high multi-layer, micro-circuit and component integration.

*BGA (Ball Grid Array): Small semiconductor package substrates applied to mobile AP, mobile memory chips, etc.

*FCBGA (Flip-chip Ball Grid Array): Medium-to-large semiconductor package substrates applied to PC CPU/GPU, servers, etc.

[Earnings by Quarter]

(Unit: KRW 100M)

[Revenue by Business Unit]

(Unit: KRW 100M)