- ▶Revenue of KRW 2.4556 trillion and operating income of KRW 360.1 billion in Q2

- - 2% increase in revenue and 1% increase in operating income compared to the corresponding period of last year (Q2 2021)

- ㆍEarnings improved on the back of the growth of high-end products such as industrial and automotive applications

- - 6% decrease in revenue and 12% decrease in operating income compared to the previous quarter (Q1 2022)

- ㆍAffected by slowing IT demand such as smartphones

- ▶In Q3, demand for high-value markets including 5G, servers and automobiles to remain strong

- - New flagship smartphone launches are scheduled, and demand for high-value products such as servers and automobiles is expected to grow

- - To expand the supply of small/high-capacitance MLCCs, high-pixel/OIS camera modules, and high-end semiconductor package substrates

- - To lay the foundation for mid-to-long-term growth by becoming the first Korean company to mass produce FCBGA for servers in the second half

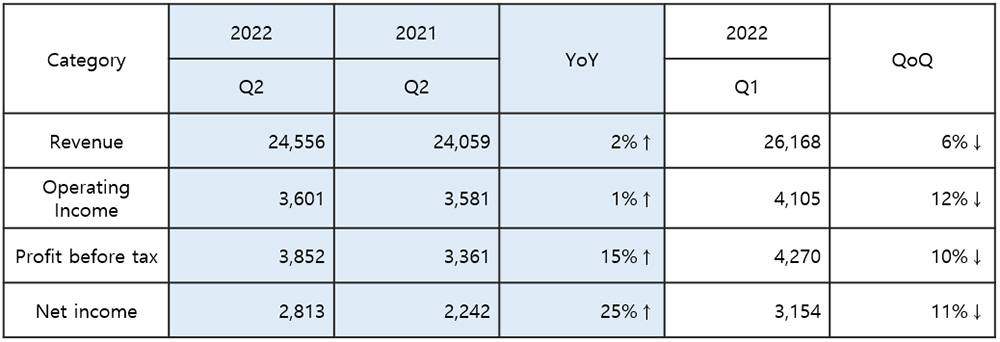

Samsung Electro-Mechanics posted revenue of KRW 2.4556 trillion and operating income of KRW 360.1 billion on a consolidated basis in the second quarter of 2022.

This marks YoY increases of KRW 49.7 billion (2%) in revenue and KRW 2 billion (1%) in operating income, and QoQ decreases of KRW 161.2 billion (6%) in revenue and KRW 50.4 billion (12%) in operating income.

In Q2, the earnings fell QoQ due to slowing demand in the IT market such as smartphones, but rose YoY on the back of increased sales of semiconductor package substrates such as industrial and automotive MLCCs and high-end CPUs.

In Q3, along with new flagship smartphone launches, demand for high value-added products such as servers and automobiles is expected to increase.

Samsung Electro-Mechanics plans to expand the supply of high-end products such as small/high-capacitance MLCCs, high-pixel/OIS(Optical Image Stabilization) camera modules, and semiconductor package substrates. In particular, the company aims to lay the foundation for mid-to-long-term growth by mass producing FCBGA for servers in the second half of the year.

Earnings by Quarter

(Unit: KRW 100M)

Earnings and Forecast by Business Unit

The Component Unit recorded Q2 revenue of KRW 1.1401 trillion, down 5% YoY and 7% QoQ due to decreased demand for IT sets, but sales of industrial and automotive products increased thanks to partner diversification and increased demand.

In Q3, demand for high value-added products such as 5G, server, and automotive products is forecast to be solid. Samsung Electro-Mechanics will expand its supply focusing on high-value products such as small and ultra-high-capacitance products for IT and MLCCs for servers and automobiles.

Optics & Communication Solution Unit posted revenue of KRW 779.1 billion, down 4% YoY and 10% QoQ due to a decrease in smartphone market demand.

In Q3, the demand is expected to recover from the previous quarter thanks to the launches of flagship models by major smartphone makers, and the automotive camera module market is projected to continually grow with advanced ADAS and autonomous driving technologies.

Samsung Electro-Mechanics plans to expand its entry into the slim camera module market for foldable phones as well as the standard high-end market, while securing diverse partners for automotive camera modules.

The Package Solution Unit posted Q2 revenue of KRW 536.4 billion, up 35% YoY and 3% QoQ thanks to increased supply of FCBGA for high-end PC CPUs and automobiles.

The demand for high-end semiconductor package substrates such as servers, networks, and automobiles is projected to continuously grow. Samsung Electro-Mechanics will expand its supplies focusing on high-end products such as multi-layer and large-area, and in particular, seek to lay the foundation for mid-to-long-term growth by becoming the first Korean company to mass produce FCBGA for servers in the second half of the year.

Revenue by Business Unit

(Unit: KRW 100M)